5 Easy Facts About The Wallace Insurance Agency Described

Wiki Article

The The Wallace Insurance Agency Ideas

Table of ContentsFacts About The Wallace Insurance Agency UncoveredAbout The Wallace Insurance Agency9 Simple Techniques For The Wallace Insurance AgencySome Ideas on The Wallace Insurance Agency You Should KnowThe smart Trick of The Wallace Insurance Agency That Nobody is Discussing

Like term life insurance policy, whole life policies supply a fatality advantage and other advantages that we'll enter later. But they have a key difference: A whole life policy never ever runs out. The primary advantage of an entire life plan is that it constructs cash money value. A section of each costs settlement you make is done away with in a various account that can be spent or accessed with a lending.The difference is that it offers the plan proprietor far more flexibility in regards to their costs and cash money worth. Whereas a term or entire life plan secure your rate, an universal plan allows you to pay what you're able to or want to with each premium. It also enables you to adjust your fatality benefit during the policy, which can't be performed with other kinds of life insurance policy.

If you have dependents, such as children, a partner, or moms and dads you're taking care of and do not have substantial wealth it may remain in your benefit to purchase a plan even if you are reasonably young. https://worldcosplay.net/member/1659169. Ought to anything happen to you, you have the peace of mind to recognize that you'll leave your loved ones with the financial ways to settle any staying expenses, cover the costs of a funeral service, and have some cash left over for the future

The 7-Second Trick For The Wallace Insurance Agency

Cyclists are optional modifications that you can make to your plan to increase your insurance coverage and fit your requirements. Common bikers include: Unintended fatality and dismemberment - Insurance policy. This motorcyclist extends your protection and can offer your household in the occasion of a crash that brings about an impairment or death (iLasting care. If a policy proprietor needs funds to cover long-lasting care costs, this biker, when turned on, will certainly give monthly settlements to cover those prices. Premium waiver. This motorcyclist can forgo costs after that event so coverage is not lost if the plan owner can not pay the monthly prices of their policy.

Auto insurance spends for covered losses after a crash or occurrence, safeguarding against feasible financial loss. Relying on your protection, a policy can secure you and your passengers. Most states need chauffeurs to have vehicle insurance coverage.

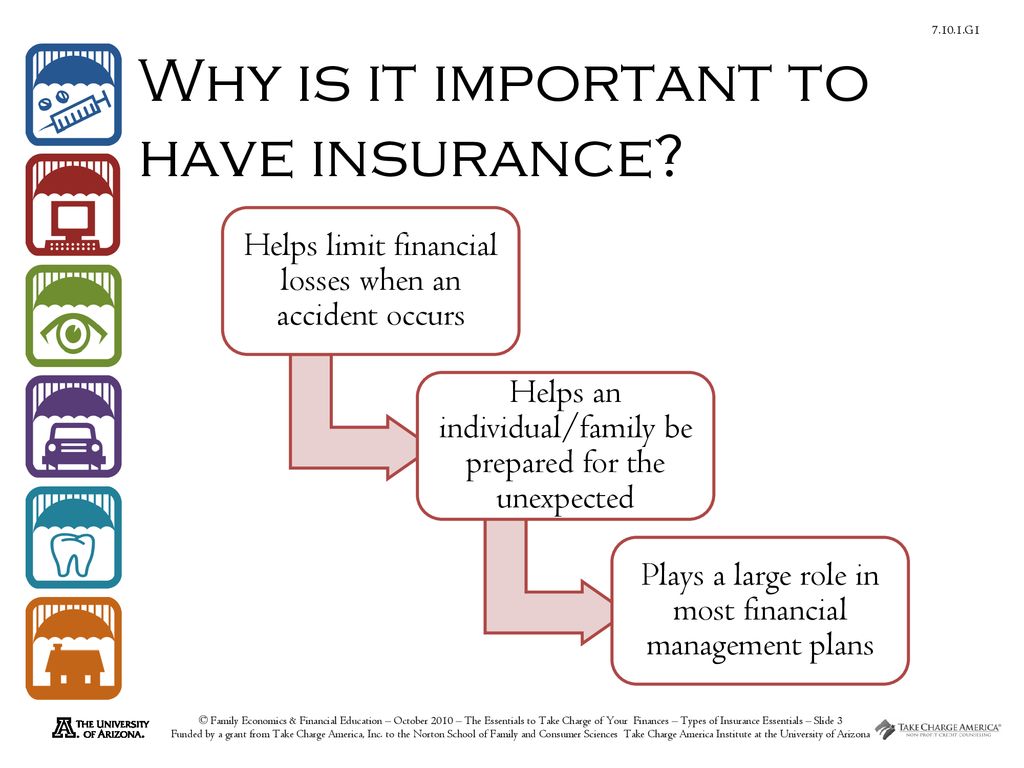

There are various kinds of insurance coverage items like life insurance coverage plans, term insurance policy, wellness insurance coverage, home insurance and even more. The core of any insurance policy plan is to supply you with protection (Home insurance).

The Buzz on The Wallace Insurance Agency

Together with the life cover, they also supply maturation benefit, causing an excellent savings corpus for the future. A prized belongings like your automobile or bike additionally requires defense in the type of automobile insurance coverage in order to secure you from out i thought about this of pocket expenses in the direction of it repairs or uneventful loss.

What will take place, if you instantly have to face the end of your life? Will your family members be able to meet their future needs without you? This is where a term insurance policy strategy can be found in helpful. Safeguard the future of your family members and buy a term insurance coverage policy that will help your nominee or dependent obtain a lump amount or monthly payout to aid them handle their economic necessities.

The Ultimate Guide To The Wallace Insurance Agency

Protect your life with insurance coverage and make sure that you live your life tension-free. Shield you and your household with the protection of your wellness insurance that will give for your healthcare costs.Life insurance policy plans and term insurance policies are very necessary to protect the future of your family members, in your lack. Life insurance coverage prepares helps with systematic financial savings by assigning funds in the type of costs every year.

Insurance coverage motivates financial savings by reducing your costs in the future. You can stay clear of expense settlements for regrettable events like medical disorders, loss of your bike, accidents and even more. It is also a terrific tax obligation saving device that assists you minimize your tax obligation worry. Insurance attends to an effective danger management in life.

Report this wiki page